And true to form the Bank of England has again chosen to on turn the cash tap and inject £75,000,000,000 into the UK economy; a measure previously known as printing money, but today euphemistically referred to as Quantitative Easing. And that's just the start as the final amount could quite possibly rise up to £500 billion.

Unfortunately, though, there will be no printing of tenners, nor minting of coins for you or for me, and the only balance sheet that is going to be inflated by this magic money - willed into existence by the push of a button - is that of the Old Lady of Threadneedle Street. And just as with the first round of QE, when the BoE created £200 billion from thin air, she will be splurging it all in the City of London. We, on the other hand, are unlikely to see any of it considering today's economic environment, and taking into account the nature of the beneficiaries of this measure, namely banks and big business.

Unfortunately, though, there will be no printing of tenners, nor minting of coins for you or for me, and the only balance sheet that is going to be inflated by this magic money - willed into existence by the push of a button - is that of the Old Lady of Threadneedle Street. And just as with the first round of QE, when the BoE created £200 billion from thin air, she will be splurging it all in the City of London. We, on the other hand, are unlikely to see any of it considering today's economic environment, and taking into account the nature of the beneficiaries of this measure, namely banks and big business.The BoE decided on this course of action after its Governor, Sir Mervyn King, discussed it last week with the Chancellor of the Exchequer, George Osborne. In a nutshell, their theory is this: the BoE creates money with which to buy gilts and corporate bonds from banks, thus shoring up their cash reserves and enabling them to lend more to businesses, who are then better able to employ people, who will in turn spend more, leading to the creation of new jobs... and, voila, a virtuous circle will have been created faster than you can get food poisoning at Chicken Cottage. Or so they hope.

Desperate measures

However, considering the Chancellor's own remarks on quantitative easing in 2009, it's not quite that simple. At the time, when his party were in opposition, Osborne said: "Printing money is the last resort of desperate governments when all other policies have failed. It can't be ruled out as a last resort in the fight against deflation, but in the end printing money risks losing control of inflation and all the economic problems that high inflation brings."

These days, though, as his government holds the reigns of the country's economy, Osborne sounds remarkably less troubled by QE, last resorts and losing control. He argues that the Coalition has "inherited as a government a pretty desperate fiscal position and have to take action." This time it's different, he and Merv say - it always is, ins't it - and we need to increase the amount of money in circulation.

Moreover, the problem we are faced with today is not deflation - it is inflation. And history is peppered with examples of what happens when central banks get carried away with their moneymaking machines, like hyperinflation in the Weimar Republic, for example, when a cartload of cash would only buy you a loaf of bread; or more recently in Zimbabwe, where bills had to be enlarged to fit the required number of zeros, only for the bank to then run into the problem of the paper costing more than what the bill was worth.

Moreover, the problem we are faced with today is not deflation - it is inflation. And history is peppered with examples of what happens when central banks get carried away with their moneymaking machines, like hyperinflation in the Weimar Republic, for example, when a cartload of cash would only buy you a loaf of bread; or more recently in Zimbabwe, where bills had to be enlarged to fit the required number of zeros, only for the bank to then run into the problem of the paper costing more than what the bill was worth.

And, in addition to this threat of runaway inflation, there still remain questions about whether QE1 even worked? Of the £200 billion that was introduced into the economy last time around, the best case estimates showed a 2% rise in GPD, at a cost of 1.5% increase in inflation, leaving a net gain of 0.5% - hardly a hurrah. Also, no one really knows what happened to that money. Some say a lot of it was kept by banks to shore up their already emaciated capital reserves, while a portion leaked out of the UK economy through deals with counterparties in other countries, and some of it enabled financial institutions to continue attracting high fliers with bumper bonuses, even in banks that would be long gone had it not been for taxpayers bailing them out.

All the while, however, the purported beneficiaries of this measure have not been impressed as small and medium enterprises (SMEs) have kept complaining that banks are still refusing them finance, even when their business was viable in every other way. The financiers, on the other hand, haven't seemed too bothered by the complaints buzzing in their ear - sure it's probably being drowned out by champagne corks going pop in the Square Mile.

Currency delusion

But, the thing is, money doesn't and shouldn't grow on trees. This truism was well encapsulated by the great... err... economist, Douglas Adams, in his seminal work, the Hitchhikers Guide to the Galaxy. In it, a group called the Golgfrancians crash land on earth and decide to create a currency using tree leaves as their money. Because these greenbacks can be found growing in every forest, inflation runs riot and a peanut ends up costing three space ships worth of leaves - a result even worse than what the Weimarians managed.

So, unless I've missed something, and we've just found £275 billion worth of rabbit furs in some attic or mined about 170,000 bars of gold from under Threadneedle Street, or worked an awful lot of overtime, then the main effect of QE for you and me will be to debase the money in our pockets because there will be a larger amount of these promises going around for the same amount of trust, thereby decreasing the value of each IOU.

The Bank of England describes its role and function thus: "The Bank's monetary policy objective is to deliver price stability - low inflation." And price stability "is defined by the Government's inflation target of 2%." However, in this respect the BoE has failed miserably - so badly in fact that it's a wonder no-one has been fired as of yet. They have overshot their own target for 60 out of the last 75 months, and not by a small margin either. The latest consumer price index (CPI) figures put inflation at 4,5% - over double the target rate - while the retail price index (RPI) is even higher, at 5.4%. Inflation will rise above 5% even by Mervyn King's own prediction, but, he insists, it will then peak and come down later next year - something we've already heard from the BoE so many times that crying wolf sounds more believable.

Of course, higher commodity prices, exchange rates, the recent VAT increase, etc., have also played their part in raising prices and forcing us to pay more for the things we want and need. But QE2 will undoubtedly make it even worse by causing inflation to soar even further from the BoE's own target, at a time when only the super rich and those lucky enough to belong to Bob Crowe's crew can expect to get commensurate pay rises.

And prices going up is hard enough for those in employment as our wages don't go quite as far as they did last month, but it is pensioners who bear the brunt of this scourge. That's because, having built up the welfare state we enjoy today, they now live off savings and their pensions as they are too old to replenish their funds through work. So, as each coin in their reserves is worth less and less, they can only look on as the true value of their pot shrinks ever smaller. According to PwC pensions are already worth 30% less than they were three years ago, and although there are also other causes at play, QE2 is sure to exacerbate the problem.

Inflating away debt

What the BoE is doing by introducing this money into our economy and thereby actively promoting inflation is actually not about helping us out in bad times, but about inflating away debt. At the moment, the UK government is £1,1 trillion in the red. Introducing all this new money into the economy, without it reflecting any real term gains made by said economy, will have the effect of each and every pound being worth less tomorrow than it is today. And the result: the value of each of those £1,100,000,000,000 pounds has decreased, thus the debt will have shrunk as well.

|

| 1 trillion in $100 notes |

And it gets even more annoying. The way the Bank of England has chosen to introduce this money into the system makes it in effect a huge transfer of wealth from you, me and Jack and Jill next door to those in a position to deal directly with the BoE, i.e. banks, corporations and the super wealthy.

The Bank could have deposited a cool £1200 on the bank account of every UK resident, thus offsetting at least part of the inflation that it causes and which is sure to make us poorer. Although not a very effective measure in the long term, it would've at least boosted consumer confidence for a while and probably a few more people would've gone down to the pub, or spa or PC World perhaps and spend a bit of their easy money.

Another option would have been to put the money into a fund from which small businesses could borrow directly - somewhat like Osbourne's new pet idea of Credit Easing - thereby bypassing the banks who so often say no. Granted, this type of government excursion into banking doesn't always work, just look at the sub-prime mortgage catastrophe or the Obama administration's unfortunate endorsement of Solyndra, but it would at least have kept a few more people in employment for slightly longer.

Or Sir Merv could have placed stringent conditions on the banks should they want to sell their assets to the BoE, stipulating that the proceeds must only be used for providing loans to SMEs and individuals, and that if any were found to have not invested the money back into the economy, then it could be clawed back.

Who gains and who pays?

Like Henry VIII, therefore, who debased England's coins in the 16th century to not far above junk so that he could keep more of the silver for his war chest, the Old Lady of Threadneedle Street has picked our pockets, by sneakily cutting a off a bit of each coin and note, and then handed those shavings over to the institutions that fund our government's incessant and unsustainable binging on debt.

|

| 16th century debaser |

And what makes this situation even worse is that not only are we being made poorer by QE as it will be administered, but that money is being funnelled to banks and corporations by buying up their products purportedly to "kicks-start the economy".

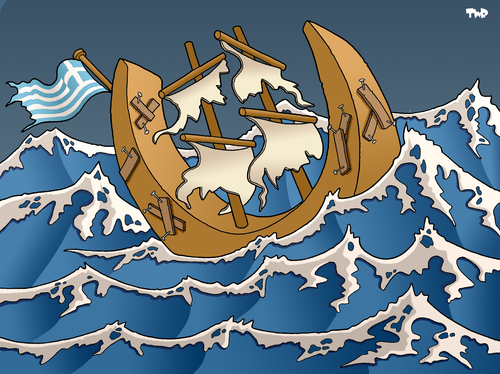

Meanwhile, all we can do is to sit and hope that the banks will do the right thing, and not just safeguard the interests of their shareholders. Unlikely, though, as all companies and banks are well aware that Greece could fall at any point, setting off an unpredictable and dangerous ripple effect, which is why it is more important than ever to leave a bit aside today for a rainy day tomorrow. And I wouldn't be surprised if it even contravened regulations for sound corporate governance not to do so because at the end of the day banks and companies are obliged to work for their shareholders, not for the public good.

So, considering that the Bank of England is debasing our money and handing a portion of it to banks and big business, and making us also pay for governmental vanity projects that got out of control, could they please at least do us a favour and stop pretending to be the guardians and protectors of our wealth? They could start, for example, by exchanging their Moneta piece - which they clearly fail to or choose to not understand - for this revised version, which is perhaps more akin to their senses of proportion.

Nothing comes from nothing, and the price for ignoring balance and only looking after abundance when administering the wealth of a nation will be paid for by the average man and woman on the high street - us consumers, pensioners and SME owners. First in percentage points, than in tens, before we hit the thousands and, if not kept in check, marching on into the millions, until the only currency left that's actually worth anything will be rabbit furs.